- Sound Money Matters

- Posts

- Global Imbalances

Global Imbalances

The Truth Few Are Willing to Admit

Friends and associates,

Global imbalances aren’t just some economist’s theory they are the cracks running under today’s world economy — and almost nobody dares to talk about the real reasons why. The Trump administration deserves some credit for at least acknowledging the problem. But as we’ll see, acknowledging a problem isn't the same as understanding it. And certainly not the same as fixing it.

China and Misplaced Blame

Global imbalances have been particularly topical recently, especially during the Trump administration’s attempts to address them through tariffs. I agree with the Trump administration that global imbalances are a major issue and I think it’s positive that they acknowledged the existence of these imbalances publicly. Very few nations are willing to confront or even admit them.

However, I disagree with the framing of China as the primary cause or enemy. China’s actions — including currency management — do play a role, but they are not the root cause. Understanding that China isn’t the root cause brings us to a deeper question: what is?

Monetary mismanagement is the core issue, and that’s why this is a great opportunity to deepen our analysis of the global economic order.

Reserve Currency Status

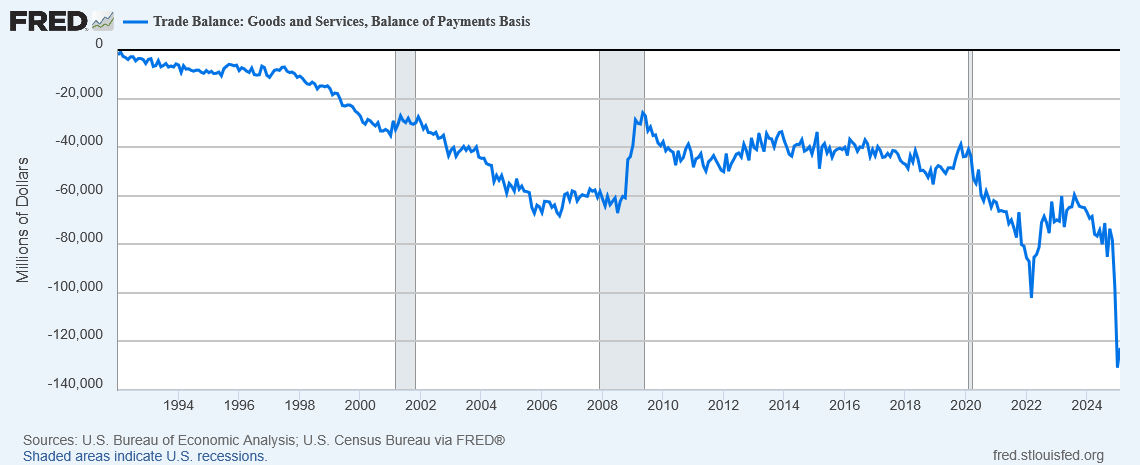

USD reserve currency status is a key cause of global imbalances. The reserve currency role implies a structural bid for the U.S. dollar — meaning that people and institutions around the world hold U.S. dollars even if they are not based in the U.S. or interacting directly with U.S. companies.

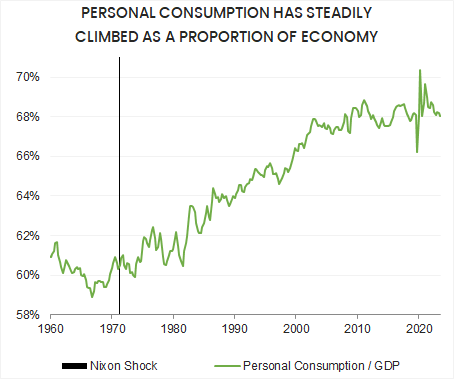

For example, entities often hold U.S. dollars to buy oil or other commodities, as commodities are predominantly priced and traded in dollars. Many global contracts are denominated in dollars, sustaining persistent underlying demand. This structural demand for dollars results in a structurally overvalued U.S. currency. Overvaluation has several consequences:

It is good for American consumers because it makes imports cheaper, supporting high levels of consumption.

It is bad for domestic production because U.S. producers face tougher competition from cheaper foreign goods.

A strong currency isn’t inherently bad if domestic price levels, including wages, are allowed to adjust downward to maintain competitiveness. However, in practice, this adjustment doesn’t happen. Instead, the structurally overvalued dollar and the resulting low domestic inflation create the economic space for loose monetary policy.

Sound Money Capital is an actively managed fund for HNWs & family offices. Fund specific commentary and factsheet available on request

Monetary Policy Intervention

Loose US monetary policy implies that domestic price levels do not adjust adequately, which leads to a reduction in domestic competitiveness, reducing exports, which prevents the trade deficit from normalising.

In addition, loose US monetary exacerbates the imbalances:

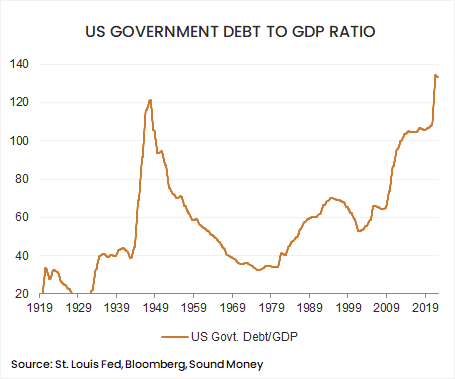

Lower interest rates results in more debt accumulation domestically, as cheap borrowing is incentivized

Debt-fueled consumption favoured rather than investment in production

A drift toward financialization, utilizing a strong currency, low interest rates, and global dollar networks

Despite the growing distortions, few are willing to name monetary policy as the culprit.

Aversion to Admitting Core Problems

No political administration — including the Trump administration — is willing to directly target the primary cause of the imbalances: monetary policy.

Governments are reliant on cheap funding to support their fiscal agenda.

In addition, open acknowledgement of the challenges presented by USD reserve currency status would be politically sensitive. Questioning the dollar’s dominance could be seen as unpatriotic or as undermining national strength.

In reality, the Trump administration — like every other administration — wants the dollar to remain dominant in global commerce. USD reserve currency status generates significant political power, allowing the US government to sanction and threaten sanctions at will. The Trump administration might want a weaker dollar behind the scenes, to boost exports and competitiveness, but they don't want to give up the dollar’s central role in global trade.

Thus, while it’s refreshing to hear open discussion of global imbalances, the conversation remains incomplete and avoids confronting the most fundamental causes:

Reserve currency dynamics

Monetary excesses driven by the Federal Reserve

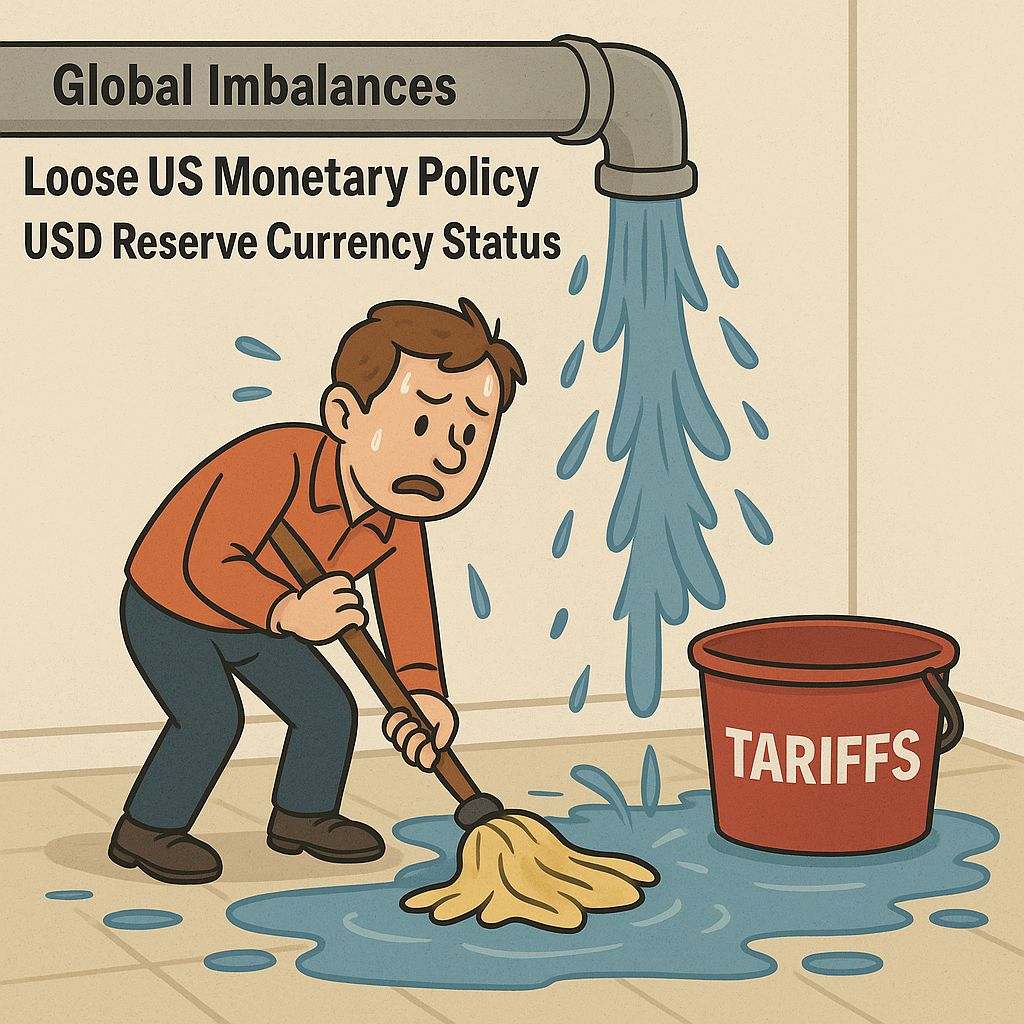

And when you refuse to confront the cause, you're left fighting the symptoms.

Tariffs Target Symptoms, not Cause

Tariffs do target the symptoms of the imbalance and could temporarily reduce the deficit. But they won’t fix it.

There are several key issues with relying on tariffs:

Production Adjustments Take Time: It takes a long time for production patterns to shift. Even if tariffs create marginal pressure, they cannot quickly or effectively reverse entrenched trade patterns.

Market Distortions: Tariffs distort the market mechanism by artificially altering prices. Buyers and sellers are prevented from discovering true price signals, leading to misallocations of resources.

Expansion of State Power: Tariffs put more control in the hands of the state, centralizing decision-making power and undermining free markets.

It is possible that the imposition of tariffs and the resulting rise in global tensions may encourage some countries to explore alternative monetary assets and technologies. In that sense, tariffs could have a small indirect impact on weakening dollar dominance over the very long term.

However, tariffs have no impact on the trajectory of U.S. monetary policy, which remains committed to looseness and excess. If you attack the symptom but not the cause, you don't solve the disease. You just change how it looks.

Implications for Bitcoin and Sound Money

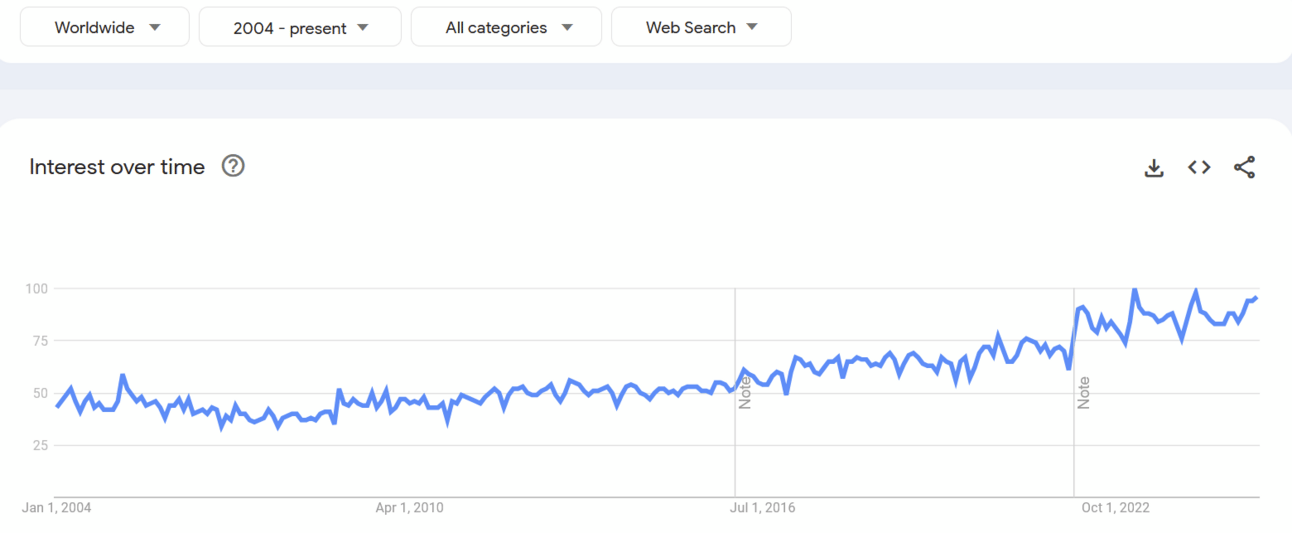

These conclusions — particularly the perpetual desire for looser monetary policy and the structural stresses within the global financial system — further reinforce our continued bullish stance on Bitcoin.

Loose monetary policy erodes the value of fiat currencies and inflates the value of alternative assets. The growing need for an alternative to the traditional dollar-based system increases the attractiveness of neutral, non-state monetary assets. Bitcoin and gold are among the very few viable alternatives available in today's environment.

All of this global tension and friction highlights the importance of neutral, decentralized, non-state assets. Bitcoin and gold stand out as the primary candidates.

The world isn’t choosing Bitcoin and gold because it wants to. It’s being pushed there by a system that refuses to fix itself. Until global imbalances are addressed at their root — loose money and reserve privilege — neutral assets aren’t just attractive. They’re inevitable.

Rob Price, CFA

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Sound Money LLC as well as Sound Money Capital LP and Sound Money Capital (BVI), whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2024 Sound Money LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS