- Sound Money Matters

- Posts

- Markets Lead Narratives

Markets Lead Narratives

Why Progress Didn’t Translate Into Price in 2025

Friends and associates,

2025 should have been a good year for crypto

We got stablecoin regulation

We got a strategic bitcoin reserve in the US

We received constructive crypto regulation in the US

The largest institutions are shifting firmly into crypto and tokenisation is widely accepted as the future

BlackRock's IBIT is the most successful ETF in financial history with >$100bn worth of AUM in 2 years.

Yet bitcoin was down in 2025, gold gained > 60% and the Nasdaq did 19%... That disconnect is worth unpacking.

TLDR: The market often prices news ahead of the event. Macro conditions tightened through H2 2025, and bitcoin is a lightning rod to liquidity, responding earlier than other financial markets.

Strategic Bitcoin Reserve =/ Bitcoin Buyers

America’s decision to shift the Treasury's bitcoin holding into reserve asset categorization is still a big deal in my opinion, elevating bitcoin to similar status as gold and Treasuries, but it did not result in net new bitcoin purchases. In the long-term, this could be a momentous decision. In the short-term, it was a disappointment – resulting in a negative price impact.

Broadly speaking, nation-state bitcoin adoption took a backburner in 2025 with El Salvador (the only country where bitcoin is legal tender) taking a less constructive approach after IMF pressure. It has always been a big leap for a sovereign nation to purchase bitcoin. We will eventually get sovereign purchases, as bitcoin walks its path to a global reserve asset, but private sector adoption may need to continue leading the charge in the years ahead.

Central Banks: Price Insensitive Gold Buyers

For the time being, gold is back in en vogue amongst states. Central banks have bought north of 1000 tones worth of gold in each of the last 3 years, surpassing gold ETF demand.

The growth in bitcoin ETF AUM was a key highlight in 2025. BTC allocation shifted from long-term holders to ETFs. The lack of ETF selling interest through Q4 2025 suggests that ETFs have, by and large, displayed a propensity to hold bitcoin for the longer-term. We will have to wait and see if this long-term focus remains intact during any potential bout of future equity market volatility.

While bitcoin ETF flows are astronomical with about $20bn worth of inflows in 2025, they pale in comparison to central bank & ETF gold purchases – approx. $140bn (Including jewelry & tech demand, gold purchases were almost double in 2025).

We maintain that bitcoin is a superior technology than gold due to its ease of transport and security. In one sense, the central bank purchases suggest that it will take more time to overcome gold's legacy as the pre-eminent store of value asset. In another sense, bitcoin has achieved remarkable success in its 17 years. The recent shift by nation-states back towards gold could be seen a slightly counter-trend move back towards gold. But the longer term trend is firmly tilted towards broader bitcoin adoption.

The incredible advances in Artificial Intelligence bought the Quantum Computing threat to bitcoin back on to the table. This kind of technical threat is not something faced by gold, highlighting some positive aspects of the yellow metal. We wrote about quantum in June and will likely follow up that piece in the coming months so we will keep things short here. TLDR: We think QC is surmountable but there is a reason its topical, it needs to be resolved and it could very well have weighed on price in 2025.

DATs: From Corporate Buyers to Extractive Entities

We predicted that corporate adoption would be a key factor in 2025, which turned out prescient. But eventually these Digital Asset Treasury became extractive, looking to sell overvalued shares in equity vehicles to investors in the hope of making a quick buck. That business model is unsustainable and purchases slowed down as soon as equity premiums dissipated. Despite the challenge, we should not overlook the achievements of Strategy in infiltrating corporate bond markets in recent years. Yes, the DAT bubble is popping, but financial engineering isn't going away. Demand for access to returns from yield starved investors in corporate bonds will remain, creating demand for some of these products.

Grift Remains an Undesirable Feature of Crypto

Grift also remained a factor in 2025 - most obviously with the Trump family, which granted political pardons to questionable participants and took advantage of the inauguration to launch an NFT at no benefit to the tax payer. It is difficult to get away from the reality that grifters find it easy to utilise crypto for their benefit.

Did the Trump Family's involvement really hamper crypto in 2025? Definitely in some ways. But in aggregate the Trump administration has done a lot of good for crypto.

I think the strategic reserve was still net positive but perhaps the gains will only be experienced long-term. In the shorter term, central bank gold purchases caused enough of a squeeze in the yellow metal to trigger more speculative retail interest than crypto. Crypto suffers from the proliferation of interest across thousands of different tokens, whereas precious metal demand is more concentrated in gold. It is impossible to know to what extent each of these factors is driving relative bitcoin performance. For us, they remain of secondary importance relative to macro conditions.

Sound Money Capital is an actively managed fund for HNWs & family offices. Fund specific commentary and factsheet available on request

Macro Remains Challenging Heading into 2026

We continue to think that bitcoin has sniffed out the macro tightness earlier than other asset classes and that 2026 could be a tougher year for risk assets as they play some degree of catch-up.

Macro conditions could potentially shift if the Fed turns the dial towards Ctrl+P ahead of the US mid-terms later this year. But the trend is lower and we are cautious under these conditions. The tighter macro environment is confirmed by slightly narrower US deficit in 2025 and softer money supply growth.

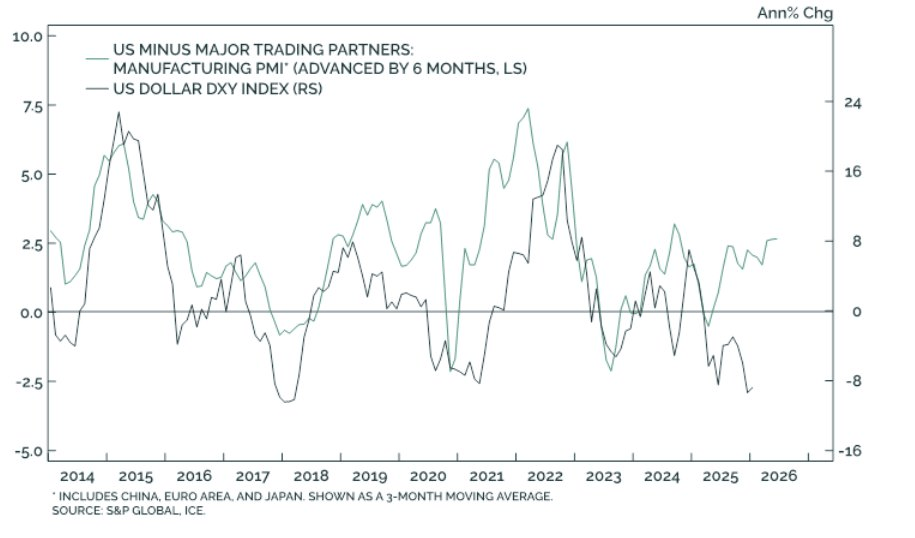

Dollar strength would be a risk in 2026 as everyone got on the back of the debasement trade in 2025. Obviously, the authorities are going to debase again, but perhaps there is a slight counter-trend move in this regard. Relative PMI differentials between the US and its major trading partners adds weight to this scenario.

The US midterm elections are another key factor in the year ahead. We expect the Trump administration could try its post-inauguration playbook again, favouring main street over wall street. Obviously they won't be as blatant as 2025, when higher yields sent markets into a speed wobble in Q1 and Q2. But greater focus on Main Street vs Wall St. could be on the cards, along with higher yields and less concern with headline market indices.

The DAT overhang isn't over. More forced selling possible if lower prices materialise. We would not be surprised if bitcoin tested the 2025 lows again, searching for liquidity below $80K. Bitcoin’s realised price distribution reveals that price did not spend a significant amount of time in the $70Ks. Usually the market has a tendency to back-fill these “air-pockets”, testing the availability of liquidity. Those levels would put the majority of ETF buyers underwater, which could trigger a fair amount of fear and capitulation. But its those types of reactions that tend to characterise market bottoms. We would gladly buy bitcoin in the mid $70Ks

On the constructive side, we must remain cognisant that sell-side pressure has eased up significantly into the new year, which is likely a key cause behind the market strength into mid-Jan. If ETFs and broader equity instruments hold up into Q2, we could very well experience a catch-up trade, with bitcoin following equity and gold higher. While we can certain envisage a more constructive scenario for 2026, the challenging macro conditions remain a guiding light in the new year, encouraging us to bide out time and remain cautious.

Neutrality Matters

Despite our caution about the market in H1 2026 we remain very optimistic about crypto’s role as neutral financial infrastructure.

We have seen major political instability in both Venezuela and Iran in 2026. These incidents highlight both power and fragility of centralised institutions. Under political oppression, there remains no better technology to store, secure and transfer value.

People need neutrality and they cannot get it from their political leaders. We expect that bitcoin will help to fill this void in the years ahead, providing a neutral arbiter of value.

Thematic Insights vs Market Views

I am cognizant that I have not provided a market update via this channel in a while. I took a conscious decision to stick to long-term and thematic insights, because it didn’t always feel helpful to distribute shorter term market views to a wider audience. If you are looking for more frequent market views, please request as much and we will add you to the fund specific distribution channel where we provide market commentary monthly.

Goodbye to Los Angeles

On the personal front, my family said goodbye to Los Angeles, leaving American shores in late 2025. We are incredibly grateful for the time, experience and opportunities afforded to us. Incredible relationships developed in crypto, finance and life in the 6 years we lived in Los Angeles. We will carry the people and places with each step we take into the new year.

Wishing you all a wonderful 2026, filled with intention, balance and celebration of whatever life throws at you.

Rob Price, CFA

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Sound Money LLC as well as Sound Money Capital LP and Sound Money Capital (BVI), whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2024 Sound Money LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS