- Sound Money Matters

- Posts

- MSTR: Trojan Horse or Ticking Time Bomb?

MSTR: Trojan Horse or Ticking Time Bomb?

A financial engineering masterclass that could reshape - and accentuate - crypto cycles

Friends and associates,

Michael Saylor and his company "Strategy" (formerly MicroStrategy, ticker 'MSTR') went from laughing stock to finance pioneers in the last 5 years. MSTR is funneling capital from traditional financial markets into bitcoin using the full capital structure to entice benchmark cognizant investors into the best investment the world might ever have seen. It is bold, but it's not without risk. This post focuses on MSTR's achievement, but it would be foolish to ignore the risks, including centralization and systemic leverage. While MSTR and the ETFs may be dampening volatility for now, a wave of MSTR copycats could intensify leverage and amplify the bitcoin cycle. One of them might even trigger the next bitcoin bear market.

From Software Firm to Bitcoin Proxy

In 2020, MSTR was a small software company sitting on $500 million in cash. Saylor saw the monetary and fiscal response to COVID, including direct transfers to households, and questioned the wisdom of holding dollars. Treasuries, real estate, equities, and gold were all considered, but bitcoin stood out. MSTR began allocating reserves to this long-duration, counterparty-free, scarce digital asset. With a market cap of $1.5bn, its bitcoin holdings quickly dominated its valuation. MSTR quickly became a pseudo bitcoin ETF, allowing investors access to a listed bitcoin proxy when very few existed.

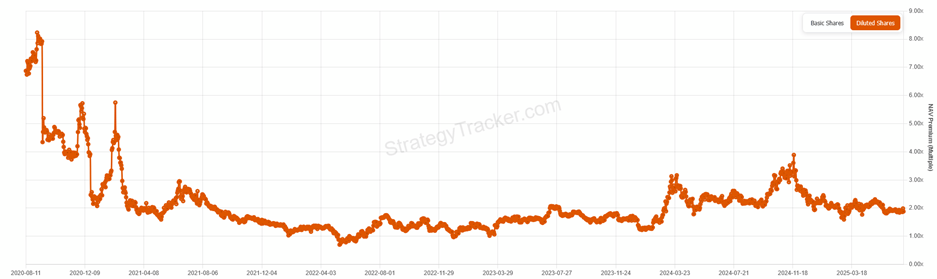

MSTR leaned into its role as a listed bitcoin proxy, but soaring demand drove its market cap well above the value of its underlying bitcoin holdings. In December 2020, MSTR capitalized on this premium by issuing convertible bonds to buy more bitcoin. This marked a major shift in strategy, introducing leverage into the equation.

MSTR premium above underlying NAV of bitoin holdings (Source: StrategyTracker.com)

Managing the Risks

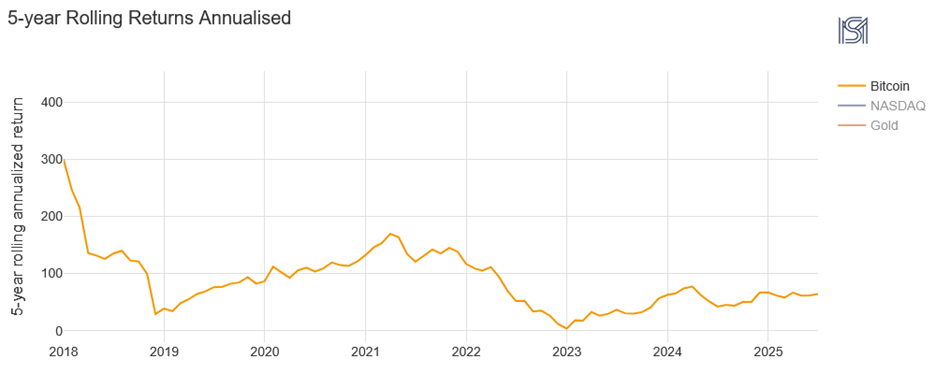

Bitcoin is volatile, but if you don’t need the capital and can stomach the drawdowns, history has been on your side. Despite multiple 80% crashes, bitcoin has never delivered a negative return over any five-year rolling period. In that context, allocating excess cash (as MSTR did in 2020) is a no brainer. We've advocated for this approach in the past.

Leverage, however, changes the game. Debt has a cost, and if the timing doesn’t line up, it can force you out of a winning position. Numerous crypto traders have been blown up trading on leverage, myself included.

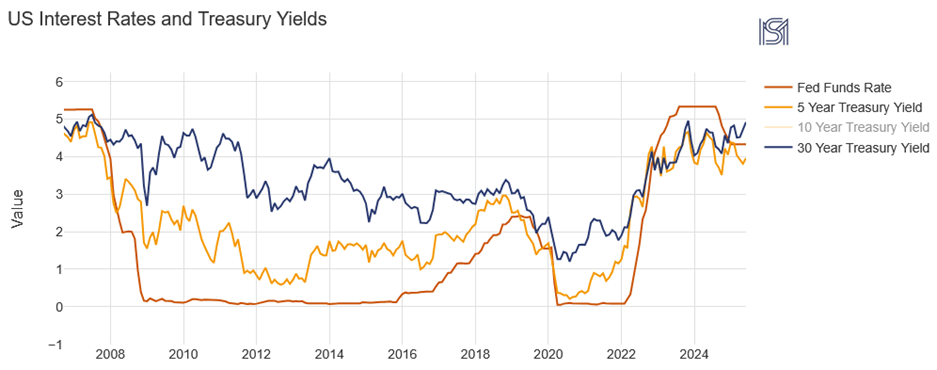

What sets MSTR apart is its access to the corporate bond market, where it can issue relatively cheap, long-dated debt. The environment in 2020 and 2021 was ideal, with rates pinned to the floor (and rates remain very low by historical standards).

MSTR aims to avoid short-dated debt, giving itself breathing room to ride out volatility. We’ll revisit the leverage question, but for now it’s clear they’re managing it well. I’m not overly concerned about forced selling anytime soon.

Funneling Capital Into Bitcoin

In 2025, MSTR added preferred stock to its toolkit, opening bitcoin exposure to another class of investors. Just as equity investors gained access in 2020, bondholders and preferred stockholders now have a route in. The doors are wide open.

This is an underappreciated part of the MSTR story. They're channeling US dollars from across the capital markets into bitcoin. This is an example of the "speculative attack on the dollar" that bitcoiners have spoken about for many years.

Breaking the Valuation Mold

MSTR could force a rethink in how investors approach valuation. (Thanks to fund director and friend David Marquart for highlighting this idea). Traditional models like discounted cash flow and dividend discounting don’t work for bitcoin, which is one reason many investors still resist it. But MSTR’s inclusion in bond and preferred stock indices means traditional allocators now have to confront this reality. They’re being nudged into studying how to value non-yielding assets, and that shift could reshape portfolio construction in the years ahead.

Saylor and MSTR may go down as financial pioneers. But with each new vehicle, the complexity rises and with each copycat, the risks grow too. Let’s look at a few of those risks.

Sound Money Capital is an actively managed fund for HNWs & family offices. Fund specific commentary and factsheet available on request

Centralization Risks

A common criticism from bitcoin skeptics is that MSTR’s accumulation runs against the cypherpunk ethos of decentralisation and self-custody. Clearly, MSTR is not bitcoin. It doesn’t let holders be their own bank. But if bitcoin is to become a global reserve asset, it's going to get a lot bigger. That growth will require adoption by large capital pools, and the convergence of tradfi and crypto is part of that reality.

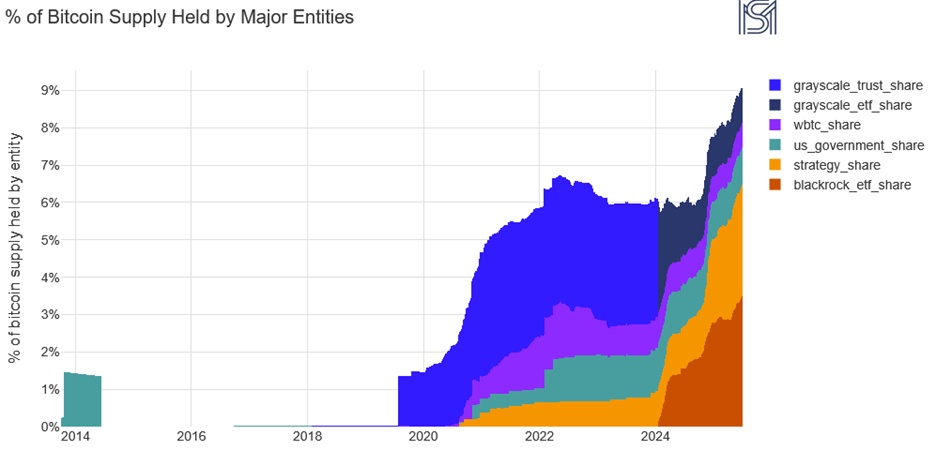

MSTR now holds nearly 3% of all bitcoin. In total, large US-based entities hold close to 10%. That raises legitimate questions around centralisation.

Centralization of Holdings Does NOT Equal Centralisation of Hash Power

Miner Hashrate determines block production and consensus. With >50%, a miner could execute a 51% attack, reversing transactions or censoring others. Hashrate centralization is a pretty substantial threat that was significantly reduced when China decided to ban bitcoin mining in 2020 - prior to which more than 50% of bitcoin hashrate was located in China. Holding an increasing share of bitcoin supply presents no risks to network stability or security.

Influence on Bitcoin Upgrades

Large holders could influence Bitcoin Improvement Proposals (BIP) which is the process through which bitcoin software development takes place. But this influence is limited by Bitcoin’s social consensus model. Node operators, developers, miners, and users all have veto power via non-upgrade or non-adoption.

Political Pressure

All major institutional holders are US-based. A hostile policy shift could hit them hard. While individuals can use cold storage across borders, the US government knows exactly where BlackRock, MSTR, and wBTC coins are held. That’s a political vulnerability worth watching.

Custody & Operational Risk

Most US-based institutional bitcoin holders custody their assets at Coinbase. This does present some degree of operational risk on their shoulders.

It is encouraging to see that MSTR is aware of this risk and thus divides its assets between Coinbase and Fidelity. I expect that if MSTR and ETF balances continue to grow as a percentage of total bitcoin assets that further custody diversification will follow.

Centralised holdings might not be ideal, but they are inevitable. These risks don’t affect bitcoin’s function today, and they don’t keep me up at night. What does linger is the potential for systemic leverage tied to these treasury companies.

Leverage: Blessing, Curse, and Cycle Driver

Every financial boom and bust is fueled by leverage. It starts with a compelling idea that gains traction. Expectations race ahead of reality. Capital pours in. Then the copycats arrive, often riskier and less disciplined. Leverage amplifies all of it, accelerating both the upside and the crash.

That’s exactly what we’re seeing in bitcoin treasury strategies today. MSTR’s NAV premium has enabled it to issue debt and equity to buy more bitcoin. But if the premium flips to a discount, as it has before, the incentives reverse. Treasury companies might become forced sellers, repurchasing equity or paying down debt instead of buying BTC. MSTR held firm through its last discount. There’s no guarantee others will.

These are centralized entities. Their response to stress depends entirely on the judgment of the people running them. That’s what makes them fragile.

Some of the risks already showing up:

Holding assets beyond bitcoin, introducing volatility and smart contract risk

Combining operational businesses with leveraged BTC treasuries

Short-term debt structures with weak rollover capacity

None of this threatens bitcoin’s long-term survival. In fact, leverage blow-ups are part of what strengthens the ecosystem. There’s no central bank here. No bailout. If you’re over your skis, market forces will find you. Every cycle brings wreckage, and we should expect more.

What’s dangerous is when leverage is hidden or misunderstood. In 2021, few realized the scale of risk building at BlockFi, Celsius, and Genesis until they imploded. Treasury companies could be the hidden risk this time around.

We’ll be watching them closely.

Admire the Vision, Respect the Risk

Love it or hate it, MSTR is a financial pioneer of the 2020s. It’s not just about Saylor - it’s a blueprint for how capital flows from tradfi into sound money. The execution has been sharp, the playbook is working, and the vehicles will keep turning heads toward the best-performing asset in history. But let’s be real: fictionalization, while inevitable, brings risk. Copycats have emerged - not all of them careful - and leverage always finds a way to overreach. We should admire what’s being built, while staying clear-eyed about what could break. I can easily imagine a scenario where the rise of treasury companies fuels the next leg of the crypto cycle - while quietly sowing the seeds of the next downturn.

Initial Coin Offering

I haven’t shared many personal updates recently, but I’d like to change that because its valuable to stay connected personally and professionally.

My wife and I are expecting a baby girl later this year. Parenthood is great, and wild! Despite knowing full well that I’ll be sleep-deprived and that #2 will be completely different to #1, I’m more excited and less nervous than last time.

I have always found that the shared experience of raising kids has helped me connect with others - parents and non-parents alike. We are all navigating this strange thing called being human. Respect to the folks who take it in their stride.

Wishing you a great month ahead, and looking forward to reconnecting when paths cross.

Rob Price, CFA

The information contained or attached herein is not intended to provide, and should not be relied upon for, accounting, legal or tax advice or investment recommendations. This presentation may contain forward-looking statements that are within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These forward-looking statements are based on management’s beliefs, as well as assumptions made by, and information currently available to, management. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to be correct. This email is for informational purposes only and does not constitute an offer to sell, or the solicitation of an offer to buy, any security, product, service of Sound Money LLC as well as Sound Money Capital LP and Sound Money Capital (BVI), whether an existing or contemplated fund, for which an offer can be made only by such fund’s Confidential Private Placement Memorandum and in compliance with applicable law. Past performance is not indicative nor a guarantee of future returns. Please consult your own independent advisors. All information is intended only for the named recipient(s) above and is covered by the Electronic Communications Privacy Act 18 U.S.C. Section 2510-2521. This email is confidential and may contain information that is privileged or exempt from disclosure under applicable law. If you have received this message in error please immediately notify the sender by return email and delete this email message from your computer. Copyright 2024 Sound Money LLC. All Rights Reserved.

NOT INVESTMENT ADVICE; FOR INFORMATION ONLY

PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS